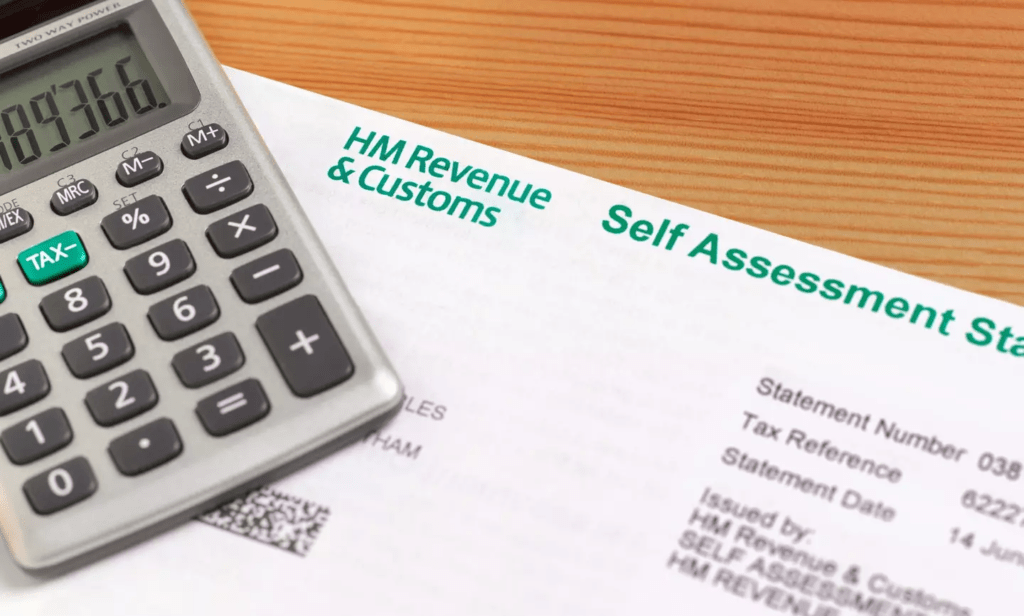

Millions of Brits Risk £100 Fines: Are You Ready for HMRC’s Self-Assessment Deadline?

A Critical Warning for UK Residents: Don’t Let the Taxman Catch You Out

As January comes to a close, millions of Brits are at risk of receiving a £100 fine in the post, all because of a missed deadline. The culprit? HM Revenue and Customs’ (HMRC) self-assessment tax return requirements. With just days left to act, now is the time to understand your responsibilities and avoid unnecessary financial headaches.

Failing to act in time can lead to penalties that quickly pile up, creating even more strain in a month already notorious for financial stress. By taking a few proactive steps, you can protect your wallet and start the year off on the right foot.

Why January Feels Like a Financial Gauntlet

January has long been considered one of the most challenging months financially. After the festive season drains your bank account, the wait for the first payday of the year can feel eternal. Add to that increased energy bills and higher costs of living, and it’s no wonder January is often called “the longest month.”

Unfortunately, HMRC deadlines don’t wait for anyone. The looming threat of a £100 fine adds even more pressure to an already stretched budget. By tackling the issue now, you can take control and avoid letting this financial burden spill into February.

Discover practical tips to budget better in January to ease the strain.

What’s the Deal with HMRC’s Warning?

HMRC, commonly referred to with a sigh of exasperation by UK taxpayers, has issued a clear warning: missing the self-assessment deadline will result in penalties. These fines start at £100 and can escalate significantly if the delay continues. With the deadline set for 31 January at midnight, there’s no time to waste.

The warning applies to millions of Brits who need to file a self-assessment tax return, many of whom may not even realize they fall under this requirement. Whether you’re self-employed, earning income from a side hustle, or managing rental properties, HMRC expects you to declare your earnings and pay what’s due.

Understand the full scope of HMRC penalties here.

What Are Self-Assessment Tax Returns?

Self-assessment tax returns may sound complex, but at their core, they’re a way for individuals to report additional income to HMRC. This applies to those earning money outside traditional PAYE systems, such as freelancers, landlords, and side hustlers. Even if your main job deducts tax automatically, additional income often needs to be declared.

Filing your return isn’t just about avoiding fines; it’s also an opportunity to ensure you’ve accurately reported your earnings and claimed all eligible deductions. For example, you might be entitled to claim expenses for office supplies, travel, or even a portion of your home utility bills if you work from home.

Check out HMRC’s guide on eligible expenses for self-employed individuals.

Why You Need to Act Now

The urgency can’t be overstated: the deadline for filing self-assessment tax returns is just days away—31 January at midnight. Missing this date doesn’t just result in a one-time £100 fine. Daily penalties of £10 will kick in after three months, reaching a maximum of £900. Beyond six months, even steeper fines are applied.

Delaying also comes with added interest charges of 7.25% on unpaid amounts, making it crucial to act now. Filing on time not only saves you money but also provides peace of mind. Set aside time today to gather your documents and submit your return to avoid unnecessary stress.

Access HMRC’s online filing system here.

Do You Need to File a Self-Assessment Tax Return?

You might think self-assessment tax returns only apply to the self-employed, but that’s not the case. Anyone earning extra income—whether from a side hustle, property rentals, or dividends—needs to check if they fall under HMRC’s requirements.

Here’s a detailed breakdown:

- Self-Employed Individuals: Whether you’re a sole trader, freelancer, or contractor, you need to declare your income.

- Side Hustlers: Earned over £1,000 from platforms like Vinted, Etsy, or Uber? You’re required to file.

- Landlords: Rental income must be declared, even if you only rent out part of your property.

- Investors and Savers: If your dividends or interest exceed tax-free allowances, they must be reported.

- High Earners: Those with an income exceeding £100,000 must file, even if they’re taxed via PAYE.

For peace of mind, use HMRC’s self-assessment eligibility checker.

What Happens If You Miss the Deadline?

The consequences of missing the self-assessment deadline go beyond the initial £100 fine. Here’s a breakdown of what you could face:

- Initial Fine: £100 for failing to meet the deadline, even if no tax is owed.

- Daily Penalties: £10 per day for up to 90 days, adding up to £900.

- Six-Month Late Fine: 5% of the tax owed or £300 (whichever is greater).

- Interest Charges: 7.25% interest on any unpaid tax, increasing the longer you delay.

These penalties can spiral quickly, especially if you owe significant tax. Filing now ensures you avoid additional stress and financial strain.

Read HMRC’s full breakdown of late penalties and charges.

How to Avoid Penalties

Avoiding penalties is simple: file your tax return on time. If you’re feeling overwhelmed, here’s how to get started:

- Gather Documents: Collect all necessary paperwork, including income statements, invoices, receipts, and expense records.

- Use Digital Tools: HMRC’s online portal is user-friendly and secure, making it easy to file your return from home.

- Seek Professional Help: Consider hiring an accountant or using tax software if you’re unsure about the process.

- Don’t Delay: Even if you can’t pay your full bill, filing on time minimizes fines and gives you options to arrange a payment plan with HMRC.

Explore step-by-step guidance for filing self-assessment returns.

Social Media Buzz: The #TaxReturnDeadline Is Trending

Amid the rush to meet the HMRC deadline, social media has been buzzing with activity as people share reminders, advice, and even a bit of humor about the self-assessment process. Here are some examples of posts trending online:

- Twitter

“Don’t wait until the last minute to file your tax return! HMRC isn’t messing around with those £100 fines. #TaxReturn2025 🚨 File it now here“ - Facebook

“PSA for all the side hustlers and freelancers out there: The HMRC self-assessment deadline is THIS FRIDAY! Avoid those penalties—here’s a quick guide on what you need to do: Learn More.” - Instagram

A popular financial influencer, @MoneyTipsUK, posted:

“Last-minute tax tips! 🕒 You only have until 31 January to file your self-assessment tax return. Avoid the dreaded £100 fine—file online now! Check it out here.” - LinkedIn

“Business owners and freelancers: Time is running out to complete your HMRC self-assessment. Don’t let a £100 fine catch you off guard. Here’s how to get it done quickly.“

These posts highlight the urgency and importance of staying compliant with HMRC requirements.

Follow HMRC’s official Twitter account for updates and reminders.

The Cost of Procrastination

As Alastair Douglas, CEO of Totally Money, advises:

“With Friday’s deadline fast approaching, it’s important to get your tax return filed as soon as possible—even if there’s nothing to pay. The taxman will be waiting to dish out £100 fines as soon as the clock strikes midnight.”

Procrastination can turn a simple task into a financial nightmare. Taking action today not only protects your wallet but also eliminates unnecessary stress. Start now to avoid scrambling at the last minute.

Conclusion: Don’t Wait Until It’s Too Late

With just days remaining, the message is clear: act now to avoid hefty fines and unnecessary stress. Filing your self-assessment tax return may not be the most exciting way to start the year, but it’s a crucial one.

Stay proactive, check your eligibility, and meet the deadline before the penalties start rolling in. Need help? Check out HMRC’s official guide to self-assessment or consult a tax expert for personalized advice.

Featured Image Credit: Getty Stock Images